See more posts about sustainABLEhouse our work in the Rio Grande Valley.

MiCASiTA offers an alternative approach to providing housing to some of the hardest to reach and most challenged communities across the country. The Rio Grande Valley, like many other communities in Texas and nationally, suffers from extreme poverty and lack of quality, affordable housing. With limited financing and design options, many housing and community development organizations are forced to either turn away or maintain long waiting lists for would-be homeowners who do not qualify for traditional affordable housing delivery models. MiCASiTA, a collaboration between the Community Development Corporation of Brownsville (CDCB), the Rio Grande Valley MultiBank (RGVMB), The Texas State Affordable Housing Corporation (TSAHC), and buildingcommunityWORKSHOP [bc] seeks to change that by offering innovative financing, and design options, tailored to grow with the homeowners needs.

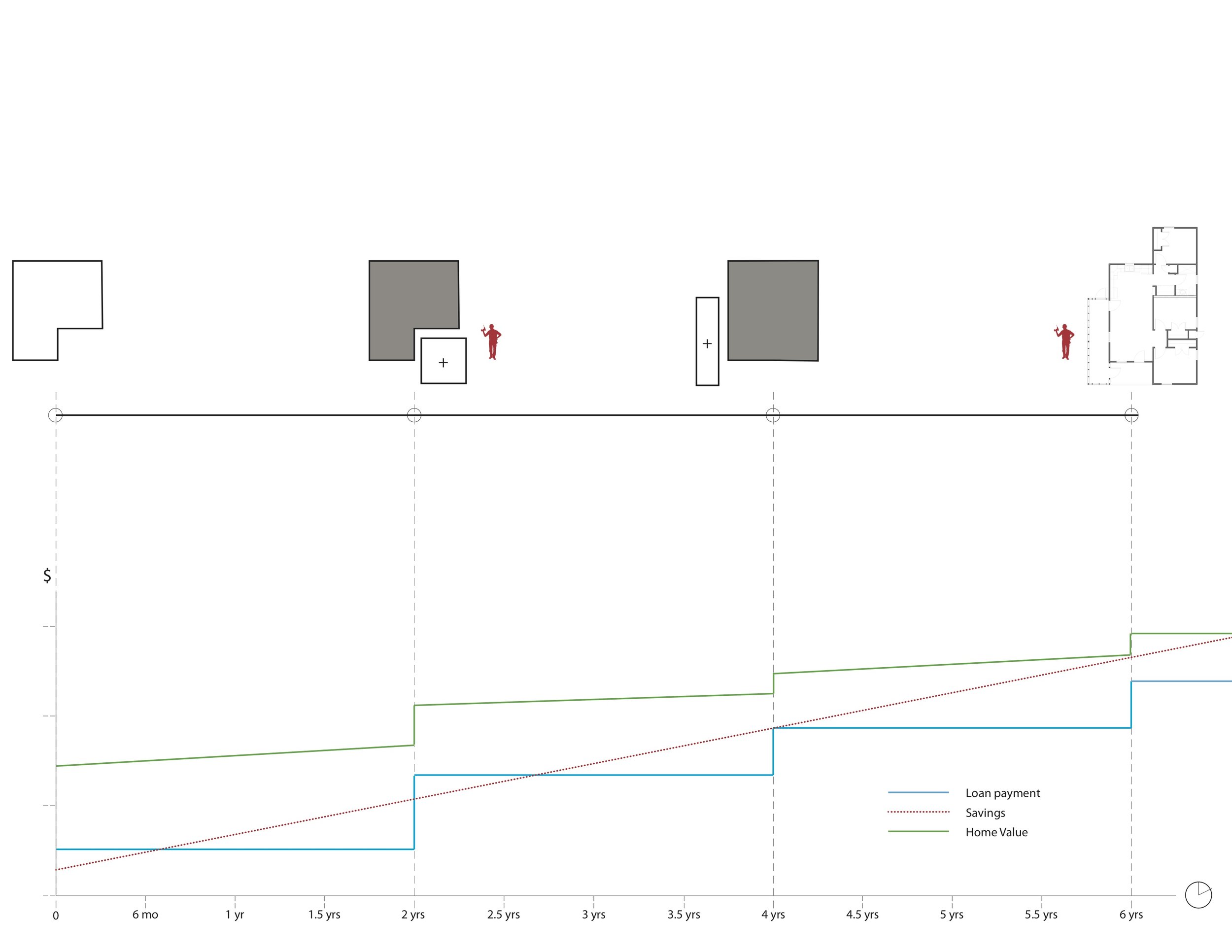

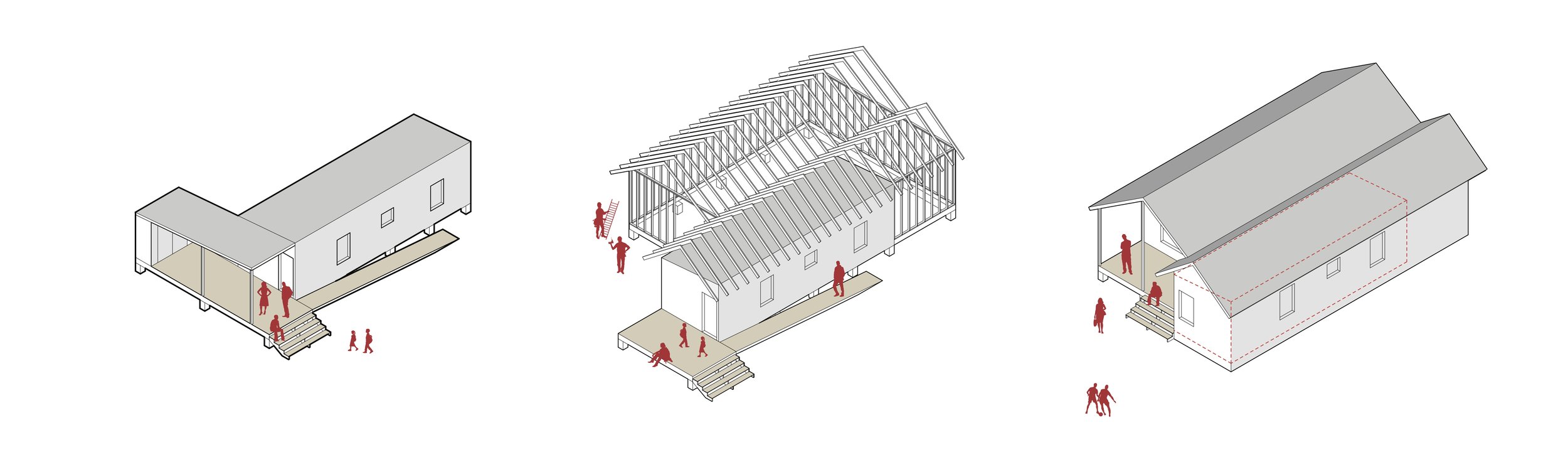

MiCASiTA offers personalized design options that empower individuals though choice while also improving sustainability and overall quality of housing. "Starter homes" are built focusing specifically on the client's needs; they can choose to initially build their home with a kitchen, living room, and one bedroom while keeping in mind that in the future they will have the option to make additions to their home. Homeowners who qualify for smaller loan amounts begin with a 600 square foot "starter home". The “starter home” is specifically designed to expand as the family's savings and financial stability grow. This approach builds on the the success of the CDCB/ [bc] RAPIDO project which created a temporary to permanent disaster recovery housing solution that starts with a small core that can be put in place immediately after a natural disaster and can grow as government assistance is available for the area.

CDCB will take clients and their families through an educational program that will prepare them to make important financial decisions with a new mortgage. In addition, RGVMB will conduct one-on-one financial and credit score counseling to ensure that the client is ready to take on the initial loan for their new home. The initial loan will cover the cost of the "starter home" and payments on this home will begin at this time. Once the client is ready, additional loans will be given in order to make additions to the home. The client's loan payments will grow accordingly with the addition of each new phase of construction. This financial program is structured and designed specifically with the client's success in mind, focusing on allowing for low interest rates, low monthly payments, longer loan terms, and deferred loan amounts.

![[bc]](http://images.squarespace-cdn.com/content/v1/5248ebd5e4b0240948a6ceff/1412268209242-TTW0GOFNZPDW9PV7QFXD/bcW_square+big.jpg?format=1000w)